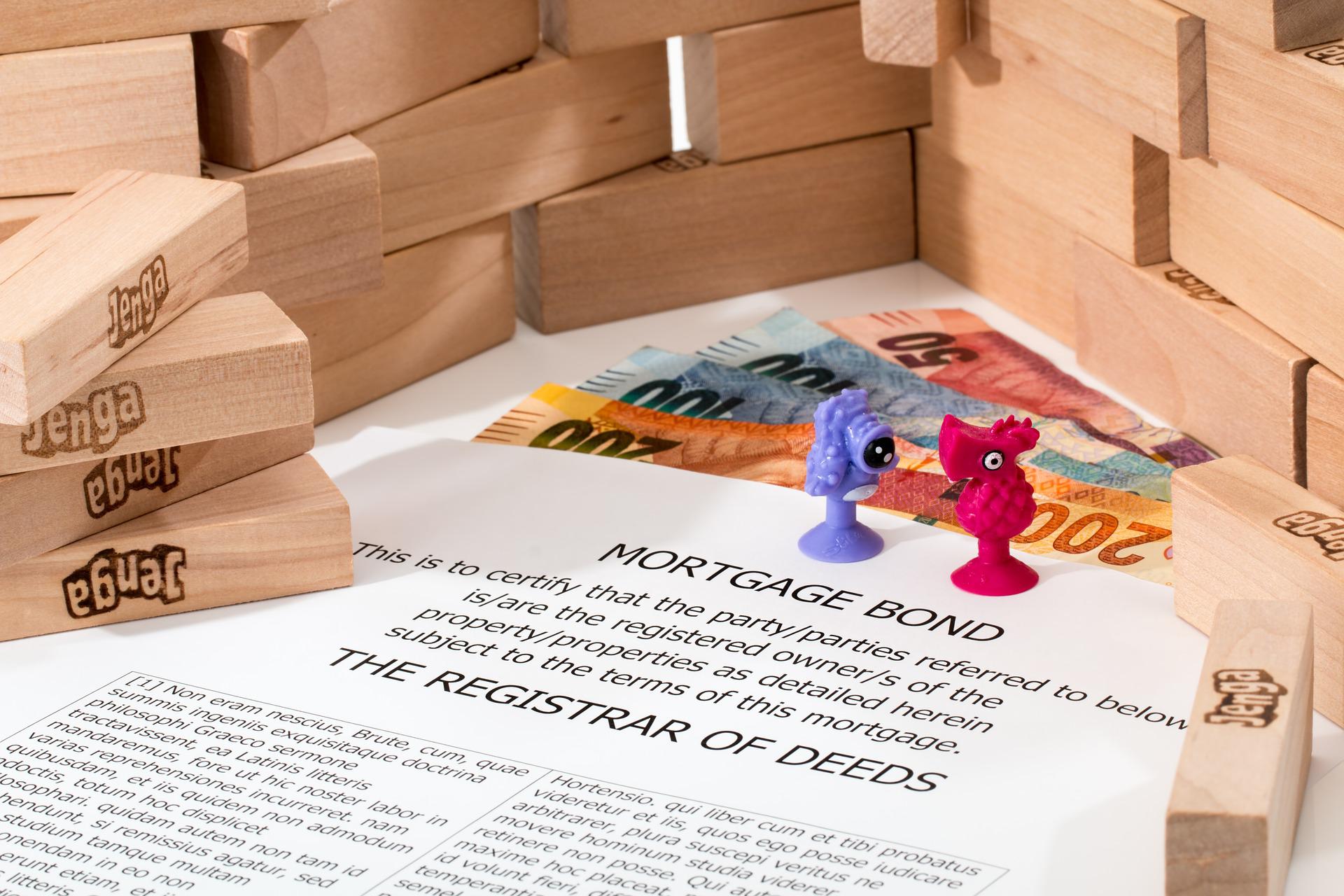

Buying your first home comes with making a lot of big decisions, and it can also be as scary as it is exciting. Hence, it is very common and easy to be confused and swept away into the whirlwind of home buying and make mistakes that could leave you with buyer’s remorse later.

For most people, the purchase of a home is often the biggest investment of their lives. With the excitement and financial implication, a new buyer often becomes prone to making errors.

Here are some of the common mistakes that first-time buyers are susceptible to making and how to avoid them.

- Over-borrowing

Due to their over-enthusiasm, first-time home buyers frequently make the mistake of opting for homes that are beyond their monetary capacity. Hence, they tend to borrow excessively and invariably regret their decision afterwards. As your house will not be your only liability in the future, over-committing to it would not only be financially draining but also mentally stressful. House purchases are long-term commitments and any effects, be it good or bad, would be felt for a long time.

- Ignoring tax benefits

The taxes that are needed to be paid upon buying a house and the rebates that can be claimed under various sections of the Income Tax Act is not very common knowledge among first-time house buyers. Not paying the taxes on your purchase of a house would lead up to tax evasion, while not claiming the rebate would mean a financial loss. In India, special tax breaks are allowed to first-time home buyers under Section 80EE and Section 80EEA and the buyers should take advantage of this provision.

- Joint home loans

Taking a joint home loan with your spouse can increase your loan eligibility and support you in purchasing a better property, but doing so also has several implications. Your spouse will be liable for the repayment of the loan if you are unable to do so, in case of default, the credit score of both the co-borrowers will be affected. Moreover, procuring a joint loan is not easy. In case of a dispute, the distribution of property will also become complicated.

- Choosing the wrong home

Credits to financial housing, it has become extremely easy and convenient to buy properties right at the initial stage of our working lives. Many buyers do not consider old age, sickness and disabilities while selecting their first home. As a result, such buyers are often forced to sell their property towards the middle part of their lives, to buy a more appropriate home, suitable for that age.

- Doing everything on your own

Home buying is a very lengthy and expensive process, involving legal as well as financial aspects. Therefore, it is important to take advice from experts, in order to perform tasks where complex legal or financial knowledge is involved. Appointing a property brokerage in order to help you find a home within your budget, will save you a lot of time and effort. In the same way, hiring a legal professional will help you take care of all the legal aspects related to property buying. Recruiting a chartered accountant may also become necessary after a point so that you are able to file your taxes and claims properly.